Authors: Jan Syrinek, Product Manager, Resistant AI | Aditi Subbarao, Financial Services Lead, Instabase

As digital transformation is changing from an aspiration to an ongoing part of normal business, the vast benefits for organizations are also accompanied by areas of concern. The pace of change and the democratization of technological capabilities has created a double-edged sword for regulated organizations — of automation vs safety. On one hand, it has allowed them to improve customer experience and product offering, streamline operations, and gain greater efficiencies on a global scale. On the other, it has also exposed them to a wide range of fraudsters with tools of equal sophistication to automate and increase their attacks, making fraud detection even more challenging.

The battlefield between fincrime teams and criminals is evolving, but the fundamental principles still apply. Every transaction conducted within a regulated framework hinges on two essential aspects:

- verifying the legitimacy of the identity involved,

- and ensuring the authenticity of the transaction

Both demand the verification of data from authentic sources and ensuring that the necessary data is readily accessible.

While this is relevant in the broader context of Financial Crime Prevention, let’s narrow our focus to Fraud, particularly as it manifests during the onboarding process within banking institutions.

Why onboarding needs a revolution

The verification of identity documents stands as a critical pillar in this process. While ID verification services have sprung up to help match faces to ID documents, that process largely leaves out a whole gamut of supporting documentation for proof of address or source of funds and wealth that can and are subject to fraud:

- Bank Statements

- Utility Bills

- Tax Teturns

- Paystubs, etc.

While that complexity may seem daunting, it is dwarfed by the challenge of trying to verify even more complex corporate entities such as Institutional Clients, Special Purpose Acquisition Companies (SPACs), Trusts, and Multinational Corporations (MNCs). Individuals within those structures may be subject to the same checks as above, but documentation from the entities themselves require checking too, including:

- Articles of Incorporation

- Registration Statements

- Shareholder Agreements

- Trust Deeds

- Financial Statements

- Contracts and Agreements

Now traditionally, these documents were verified manually—which allowed for a certain level of risk management—face to face interactions are high-risk, non-scaleable endeavors for criminals.

But in the high-frequency, high-velocity online world, manually processing these documents requires a person to both (i) determine if the document is authentic, and once authenticity is verified, to (ii) extract and validate the required data from that document—all in increasing volumes and within strict SLAs. This brings with it a host of challenges:

- it’s slow and time-consuming, driving up operational costs, lengthening turnaround times and creating frustration and potentially attrition in legitimate customers.

- it’s prone to errors, impacting confidence in the organization and in some cases economic as well as regulatory consequences.

- it’s risky, since manually verifying the authenticity of digital documents is extremely difficult—many of the changes are just not visible to the naked eye, and risk teams cannot share a history of the documents they’ve seen to catch template-based frauds.

Change has started slowly in this space – with institutions trying to automate either the extraction of data, or of verifying documents. But each by itself is not sufficient.

Even when an institution sets out to automate their document processing, automating unverified documents is an open invitation to automate fraud. Faced with that uncertainty, many who have gone down that road realized they needed to keep a manual check before processing documents—defeating the purpose of their investment.

By the same token, even if technology is used to speedily verify if a document is genuine, manual extraction of key data from that document falls significantly short of end to end automation requirements.

So how does an organization solve for both pieces of the puzzle?

The revolution is now

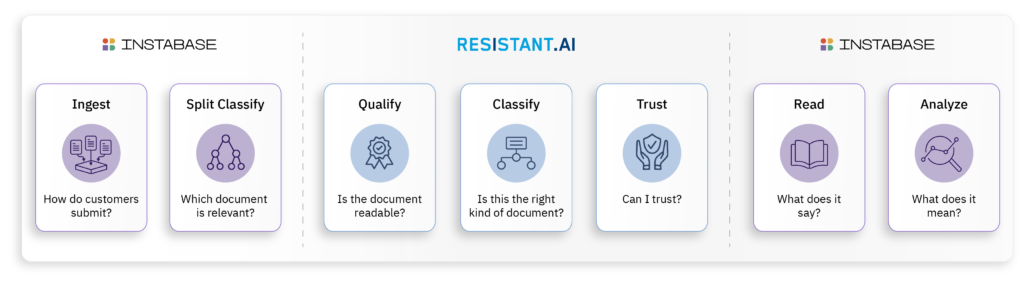

When broken down, every document processing workflow in a fraud-prone environment includes the following “jobs to be done”:

- Ingest: How can I collect the document from customers, or allow them to submit their documents.

- Split-classify: How can I split up document packets and classify into different types? Can I identify and focus on the specific document that is relevant to my task?

- Qualify: Can I read the document, or is it blurry, has flash glare, or other imperfections that might hide fraud or hinder data extraction?

- Classify: Is this the right kind of document, or is it irrelevant? Does it match what I know about such documents?

- Trust: Can I trust this document? Is it authentic, or has it been tampered with?

- Read: What does the document say? Can I extract the information it contains?

- Analyze: What does the document mean? Can I mine the information for insights and decisions?

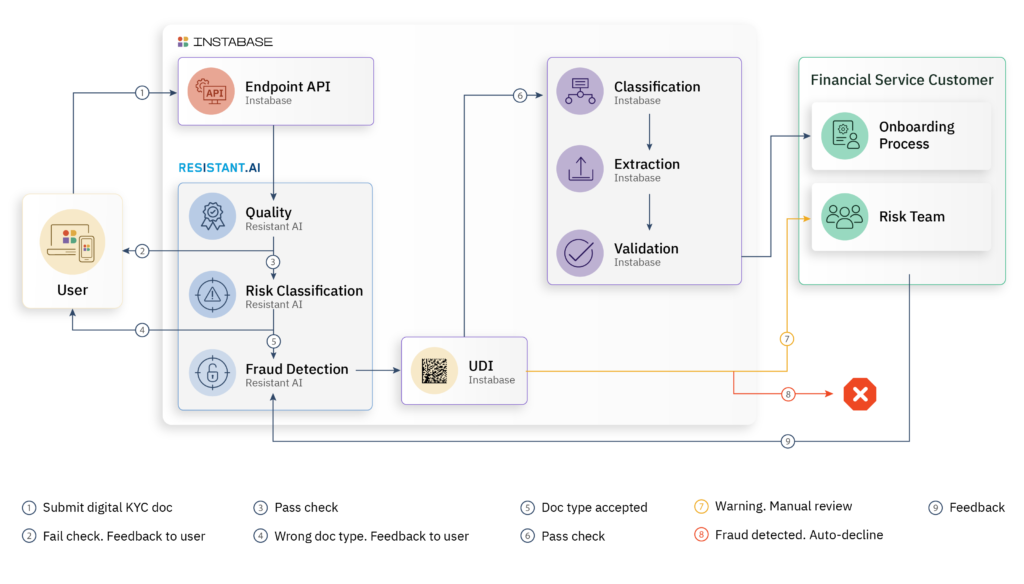

The combination of Resistant AI and Instabase introduces a paradigm shift by automating all of these critical processes — allowing customers to use automation for both document verification as well as data extraction.

Resistant AI’s Document Forensics detects document fraud in digital documents that are otherwise invisible to the naked eye, employing an ensemble model approach for robustness across document types and formats, helping customers detect:

Universal document fraud typologies that don’t require prior knowledge (or modeling) of a specific document.

Anomalies—or deviations—in known or modeled documents automatically built from as few as 20 samples.

Template farming of documents across accounts to stop organized criminals committing serialized fraud.

Customers relying on Resistant AI alone have been able to detect +32% more fraud, reduce manual reviews by 90% and speed up customer onboardings by 60%.

Instabase’s AI application platform leverages cutting edge generative AI to automatically understand, extract, analyze, and generate any data with human-level accuracy. This allows customers to transform complex, unstructured data into actionable insights by minimizing manual processing and facilitating quicker, more informed decision making, through:

High accuracy across the widest coverage of documents and files – no matter the format, layout, or language (e.g.) PDFs, CSVs, images, emails, presentations, and more.

Rapid deployment and integrations with zero model training and pre-built apps for common document types – to quickly extract, clean, and standardize data in the format required.

Ease of embedding into any workflow through scalable APIs, incorporating robust data security measures and augmentation of AI models with high-precision data validations and humans in the loop — to verify results against a range of quality checks and business rules to maximize good results, minimize bad results, and increase automation rates.

Using both of these technologies together can tackle the problem of data automation end to end. The collaboration between Instabase and Resistant AI now offers a seamless combination of both platforms, enabling organizations to trigger custom-made workflows perfectly adapted to an institution’s specific risk appetite and business process.

Resistant AI & Instabase document processing workflow

A new era collaborative solution for document fraud prevention

Combining Resistant AI and Instabase presents a new way to tackle fraud, significantly enhancing the accuracy and speed of data verification, reducing the pain and inefficiencies associated with manual review, and delivering on digital’s promise of improved customer experience and accelerated growth.

By automating both document verification and processing, banks can now access verified and authentic data swiftly, thereby accelerating decision making and risk management — reducing the threat of fraud substantially. This strategic partnership symbolizes a step forward in addressing the modern-day challenges posed by fraudsters, making it an invaluable asset for risk and fincrime teams in banks striving to fortify business critical processes such as KYC, merchant onboarding, mortgages and loan origination, investing and more against fraudulent activities.

Reduce the threat of fraud substantially

Automate document verification and processing, and accelerate decision making process.