Expense tracking and management is a necessary but costly part of a business that takes a lot of time and human resources. Tedious data entry and review processes rely on employees to accurately input and verify information, in addition to using time that could be allocated to activities that drive business growth instead. These shortcomings make a strong business case for handing off these functions to an AI expense tracker.

Technology advancements like optical character recognition (OCR), machine learning, and generative AI can help companies and financial teams track and report on expenses more efficiently and accurately than ever before. By using AI, companies can free up their employees to focus on strategic and revenue-generating work while checking expense tracking off their to-do lists.

Here’s how AI works for expense automation and how you can implement AI expense management with Instabase AI Hub.

Benefits of Using AI for Expense Tracking

An AI expense tracker offers a range of benefits, from time savings to accuracy and efficiency, to everyone across the company — not just the finance and accounting teams.

| Fewer Errors | – Less manual data entry – Automatically categorize expenses in seconds – Accurate calculations |

| Increased efficiency | – Reduced time and demand on financial teams and employees – Automatically extract data from receipts and fill in expense reports – Automated reviews and approvals of expense reports |

| Increased compliance | – Ensure compliance with expense policies with immediate answers to employee questions – Real-time approval and budget updates |

| Better employee experience | – Make expense tracking faster and easier – Increased employee productivity |

Fewer Data Entry Errors

When data entry relies heavily on human involvement, there’s an increased chance for error. For example, an employee might key in a wrong number or move a decimal. AI removes most manual data entry, extracting data exactly how it appears in documents, receipts, or forms so nothing is lost in translation.

Using OCR and natural language processing, AI can also detect the type of expenses and categorize them accordingly. This not only saves employees additional time, but also reduces the risk that items will be miscategorized and therefore messing up accounting and reporting.

AI can perform a myriad of accurate calculations using formulas or instructions given using natural language. Some AI can also show its work by displaying the numbers and formulas it uses and the steps it takes. You can easily double check the calculations, and it creates an audit trail that can be referenced later.

Increased Efficiency

AI cuts down on the time that managers and finance teams spend reviewing and approving expense reports. It can double check that expenses have been properly categorized and are within the approved limits. For example, your company policy allows employees to spend up to $800 per round trip flight. AI can automatically approve the expense if it’s $800 or less and flag the report when it contains a flight over that amount.

For employees, AI can automatically extract data from receipts and auto-fill forms and reports. Employees only have to upload their receipts. AI will do the rest, saving them precious minutes or hours.

Increased Compliance

AI makes it easier for employees to comply with their company’s expense policies by helping them stay on top of how much they can spend or how much is left in their budget.

When expense management relies on human review, there may be a waiting period between the time a purchase is made and the time it’s earmarked for reimbursement or approval. This can make it look like there are more funds available, which could lead to overspending. With a shortened processing and approval timeline, all employees and departments can gain a better grasp on their finances.

Gaining insight into company spending limits or your budget is also easier with AI. Instead of asking someone from the finance team and waiting for a reply or searching through documents or your company wiki, you can ask AI and get an immediate answer.

Improved Employee Experience

Expense tracking is a multi-step process that requires employees’ valuable time. Employees need to collect receipts, scan or take a photo of them, carefully enter the details into an expense report, and categorize the expenses. It’s time-consuming and tedious, causing many employees to put off submitting their expenses.

AI turns expense reporting from something employees dread doing to a simple, fast task that doesn’t kill their productivity. All employees need to do now is provide their receipts, and AI will handle the rest.

AI Use Cases in Expense Tracking

With these benefits in mind, let’s see how AI can be used for expense tracking and management to save time, speed up processing and reimbursement, and provide valuable insights.

- Populate fields in expense reports based on receipt images or scans

Rather than manually pairing receipt information with form fields, AI can auto-fill forms with receipt data. Users upload their receipts and then AI fills in the blanks.

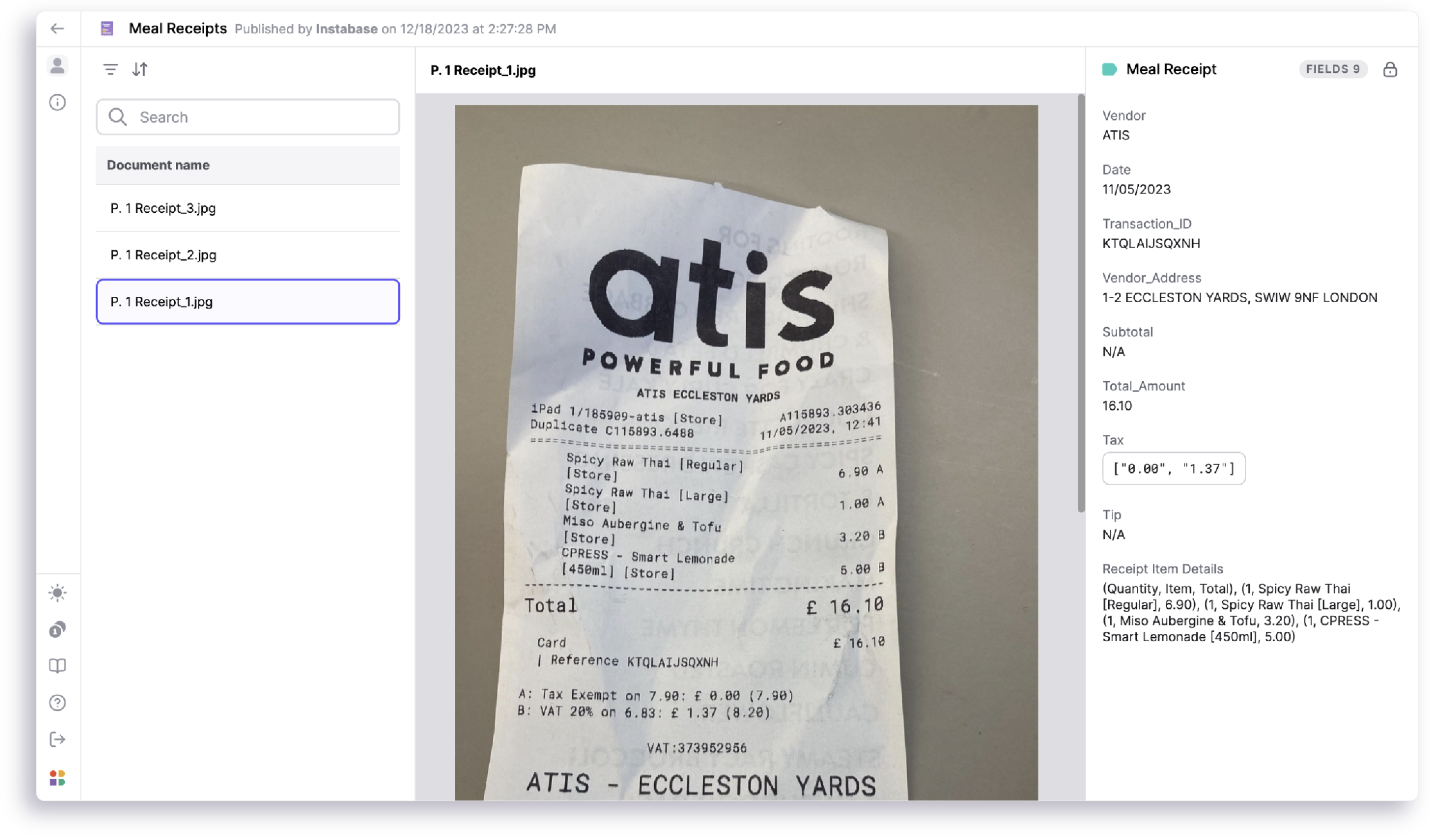

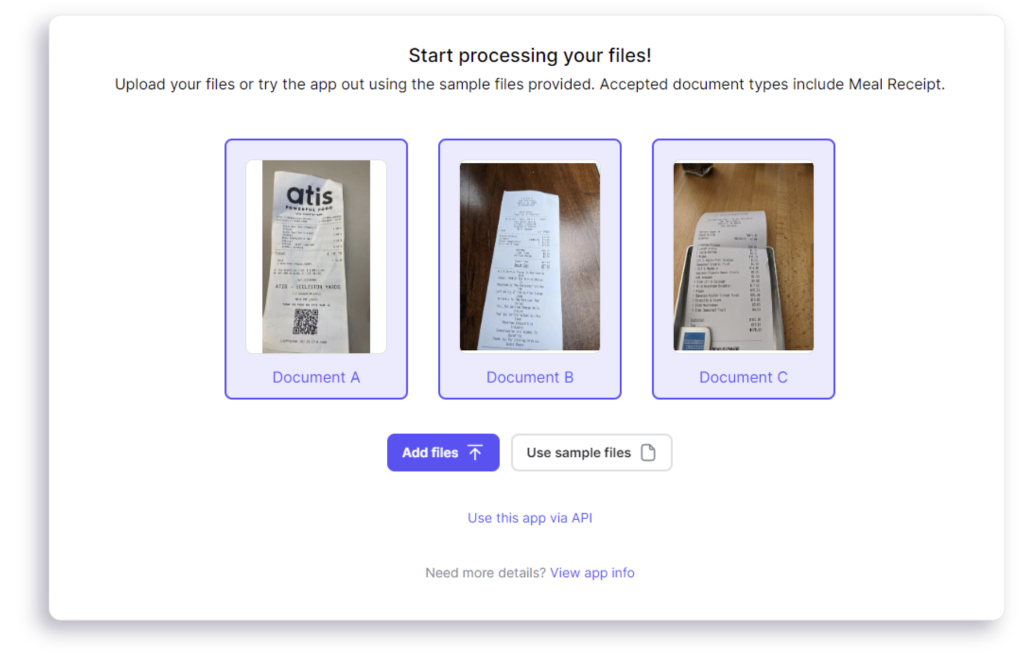

In the example shown below, Instabase’s Meal Receipt app has extracted the vendor, date, total amount, tax, and other data from an uploaded receipt. Companies can integrate Instabase with other systems, creating an automated workflow where Instabase automatically inputs the extracted data into the corresponding fields in another tool or platform.

- Automatically categorize expenses

Finding the right category type or codes for each line item takes extra time when submitting expense reports. AI can automatically label expenses based on your unique categories and subcategories, ensuring that funds are correctly attributed and come out of the right accounts.

- Ensure employee expenses comply with your company policies

AI adds an automated layer of compliance to expense reporting by verifying the validity of expenses and flagging non-compliance for manual review. For example, if an employee’s spending exceeds the limit or puts a transaction under the wrong category, AI can detect these errors and alert the employee’s manager or the accounting team. This also cuts down on time spent reviewing each submission and enables faster reimbursements.

- Recognize duplicate transactions

Duplicate transactions happen — either because an employee accidentally entered a duplicate expense or because they were charged twice by a vendor. The consequences for duplicate transactions can be costly if they’re not caught. AI can automatically detect possible duplicate submissions and automatically remove them or flag them for manual review.

- Detect fraud

AI can look for patterns in expense data to detect employees abusing spending privileges, submitting duplicate or fake receipts, or otherwise committing fraud. These inconsistencies can be flagged for further review.

- Convert currencies

If you’re a global company with offices around the world or you have employees that travel internationally, AI can automatically convert currencies from different countries. AI performs currency conversions with a high degree of accuracy and consistency.

- Provide insights into spending

Finance teams can use AI to easily slice and dice the data however they want and generate reports, helping them stay on top of the company’s financial health and cash flow. Department leaders can see how their budget is used, categories that have the most spending, and which teams or employees are making the most purchases. All of this data is useful in setting budgets and managing spending.

Automating Expense Tracking With Instabase AI Hub

The easiest path to using an AI expense tracker is to implement Instabase AI Hub in your financial workflows. AI Hub is a suite of AI applications that are trusted by some of the world’s top financial services companies to automate document and data-heavy processes.

Instabase excels at handling unstructured documents, such as receipts and images. Receipts look very different from each other, which can make it difficult for AI tools to accurately detect and extract the data. However, Instabase uses multiple large language models and deep learning models, including OpenAI’s GPT-4 and its own proprietary ones, to successfully pull out the information in receipts and other unstructured documents.

There are two apps in the AI Hub that can help automate your expense tracking: the Converse and Meal Receipts apps. While these apps are useful on their own, they’re even more powerful when combined with the Build app, which allows you to build end-to-end automated workflows.

Converse: Versatility for All Receipts and Documents

The Converse app enables users to “converse” with any document or image, helping you quickly understand, extract, analyze, and manipulate the information in your files. It can be used for a wide range of purposes, including processing receipts of any kind.

Just upload your receipt(s) and tell Converse the data you’re looking for and how you’d like to format it (e.g., table, list, JSON). It’ll extract the specified data from one or multiple receipts, allowing you to process multiple receipts from the same employee or department at scale.

Meal Receipts: Purpose-Built for Dining Expenses

The Meal Receipts app is specifically built to process restaurant receipts and extracts nine data fields: vendor name, date, transaction ID, vendor address, subtotal, total amount, tax, tip, and item details. Simply upload your digital receipts or photos of printed receipts and these data fields will be automatically identified and provided to you. Copy and paste that data into another system, or upgrade your account for more capabilities, including editing, sorting, and filtering the data.

Build: Automate Your Workflow

While the Converse and Meal Receipts apps are useful for one-off scenarios where you only have one or a few documents, a more efficient option is to automate expense management processing using the Build app. Build lets you create automated workflows for specific document types, such as receipts. Specify the data points you want to extract and how you’d like to extract them. You can also integrate third-party systems, removing the manual work of uploading receipts and copying and pasting extracted data.

Use the Build app to:

- Convert extracted data, such as dates and currencies, into the the format accepted by your expense management system

- Set validation rules and flag items for human review that do not meet these rules

- Set limits on certain expense types

- Create a rule to only approve expenses that are less than 30 days old (or any chosen time limit)

Get started with an AI expense tracker by trying Instabase AI Hub for free. Securely upload your receipts, start extracting expense data in minutes, and see how it helps you process expenses faster.

Automate Your Expense Tracking in Minutes

Leverage Instabase’s AI solutions to make expense management more efficient.